SUMMARY

Auction volume increased in August 2024 and pricing dipped. Retail volume was typical, and depreciation was normal, with daycabs continuing to depreciate at a rate greater than sleepers.

CLASS 8 AUCTION UPDATE

Sales volume at auctions in August increased moderately from July. Pricing was lower than last month, due partly to actual market movement but also unfavorable condition and mileage of trucks in the dataset this month.

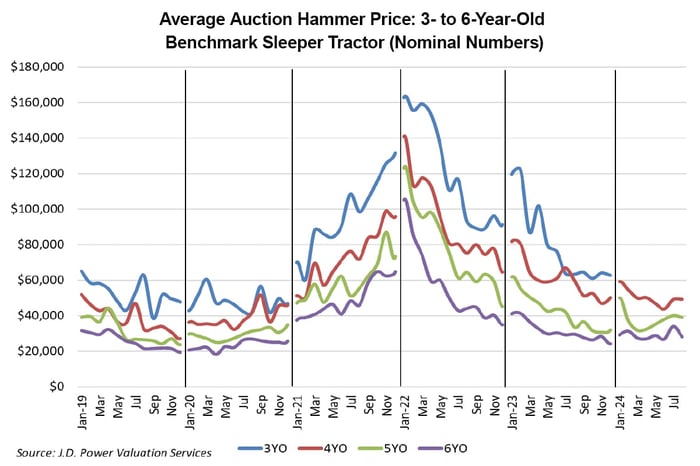

Looking at late-model sleeper tractors, average pricing for our benchmark truck in August was:

- Model year 2021: $49,186; $111 (0.2%) higher than July

- Model year 2020: $39,049; $1,016 (2.5%) lower than July

- Model year 2019: $27,933; $5,978 (17.6%) lower than July

- Model year 2018: $22,076; $97 (0.4%) lower than July

In August, selling prices for four- to six-year-old sleepers were 5.6% lower than July. Pricing is currently just under the strong pre-pandemic period of 2018 in nominal figures (20% lower if adjusted for inflation), and 55% higher than the last market nadir in late 2019 (27% higher if adjusted for inflation). Depreciation in 2024 is averaging 1.3% per month, substantially lower than the historical average. All of this year’s depreciation occurred in the first quarter, with pricing stable since then.

CLASS 8 RETAIL UPDATE

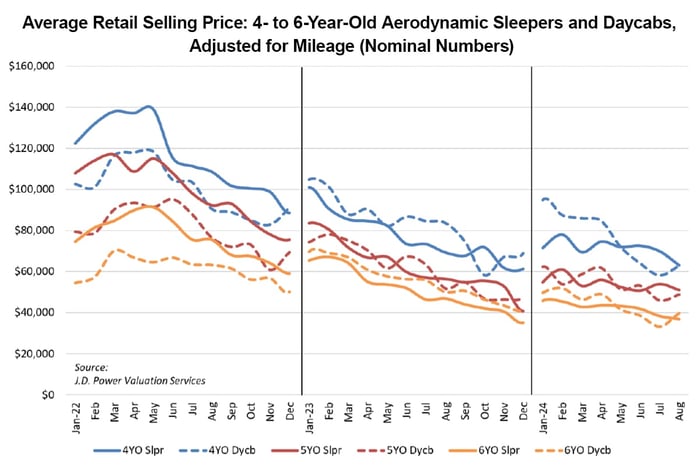

Retail sleeper pricing dipped mildly in August, while daycabs had a stronger month. However, the sleeper market overall remains more stable than the daycab market.

Overall, the average sleeper tractor retailed in August was 64 months old, had 430,980 miles and brought $57,872. Compared with July, this average sleeper was identical in age, had 8,802 (2.0%) fewer miles and brought $3,760 (6.1%) less money. Compared with August 2023, this average sleeper was seven months newer, had 17,572 (3.9%) fewer miles and brought $6,694 (10.4%) less money.

August’s average pricing for late-model trucks was as follows:

- Model year 2023: $116,376 $6,284 (5.7%) higher than July

- Model year 2022: $89,751; $1,626 (1.8%) lower than July

- Model year 2021: $63,000; $6,828 (9.8%) lower than July

- Model year 2020: $50,909; $3,031 (5.6%) lower than July

- Model year 2019: $36,903; $6,312 (14.6%) lower than July

- Model year 2018: $29,122; $44 (0.2%) higher than July

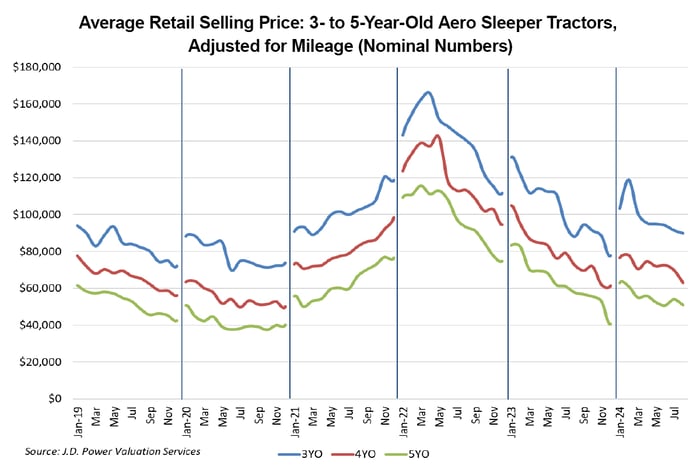

Three- to five-year-old sleeper tractors brought 3.9% less money in August than July, and 5.3% less than August 2023. Late-model sleepers are now bringing 5% less money than the last strong pre-pandemic period of early 2019 in nominal dollars, or 24% less when adjusted for inflation. Compared with the last weak pre-pandemic period, late-model sleeper values are running 19% higher in nominal dollars or 3% lower in real dollars. Depreciation in 2024 is averaging 2.3% per month, which is historically typical.

Moving to the daycab segment, trucks sold retail in August recovered most of last month’s drop, averaging 10.1% more money. Compared with August 2023, this segment brought 18.5% less money. Despite August’s recovery, average monthly depreciation in 2024 for this segment remains substantially higher than historical trend as well as the sleeper segment, at 4.7%. Highway-spec, 13L units with average mileage continue to depreciate.

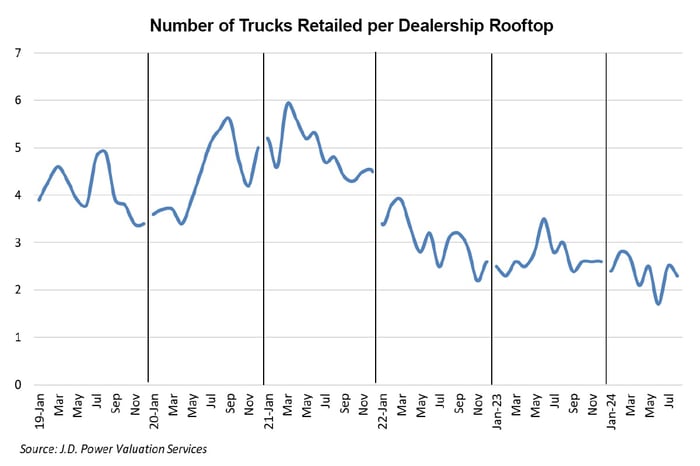

Dealers sold 2.3 trucks per rooftop in August, 0.2 higher than July. Overall, 6% fewer trucks were reported sold retail in August vs. July.